All businesses operating in the UAE that are Taxable Persons must register for and file Corporate Tax returns to avoid penalties. Corporate Tax is a federal direct tax levied on Taxable Income (adjusted accounting profits) at rates of 0% or 9%. The introduction of Corporate Tax supports the UAE’s strategy to diversify revenue sources and strengthen economic sustainability.

What businesses must register for corporate tax?

- All businesses located on the mainland

- Free zone companies

- Banking and financial institutions

- Foreign companies with Permanent Establishment in the UAE

Note that even businesses eligible for 0% tax (e.g., under Small Business Relief or Qualifying Free Zone Persons) must register and file returns unless they are fully Exempt Persons.

What companies are exempt from corporate tax in the UAE?

- Companies engaged in the extraction of natural resources

- Dividends and capital gains from shareholdings

- Income from dividends, interest, and royalties to foreign investors

- Government Entities and Government-Controlled Entities

- Public and private pension funds or social security

Company tax registration in the UAE

First of all, you need to gather the required documents to avoid delays or rejection of your application.

Documents required for tax registration

- Having a valid business license

- Preparing financial reports to determine the income threshold

- Preparing company information, including details of ownership, business activities, and its legal structure

- Bank account details for tax payment

- Full contact information, including registered address and contact details of the authorized person

To register, you need to follow the following steps:

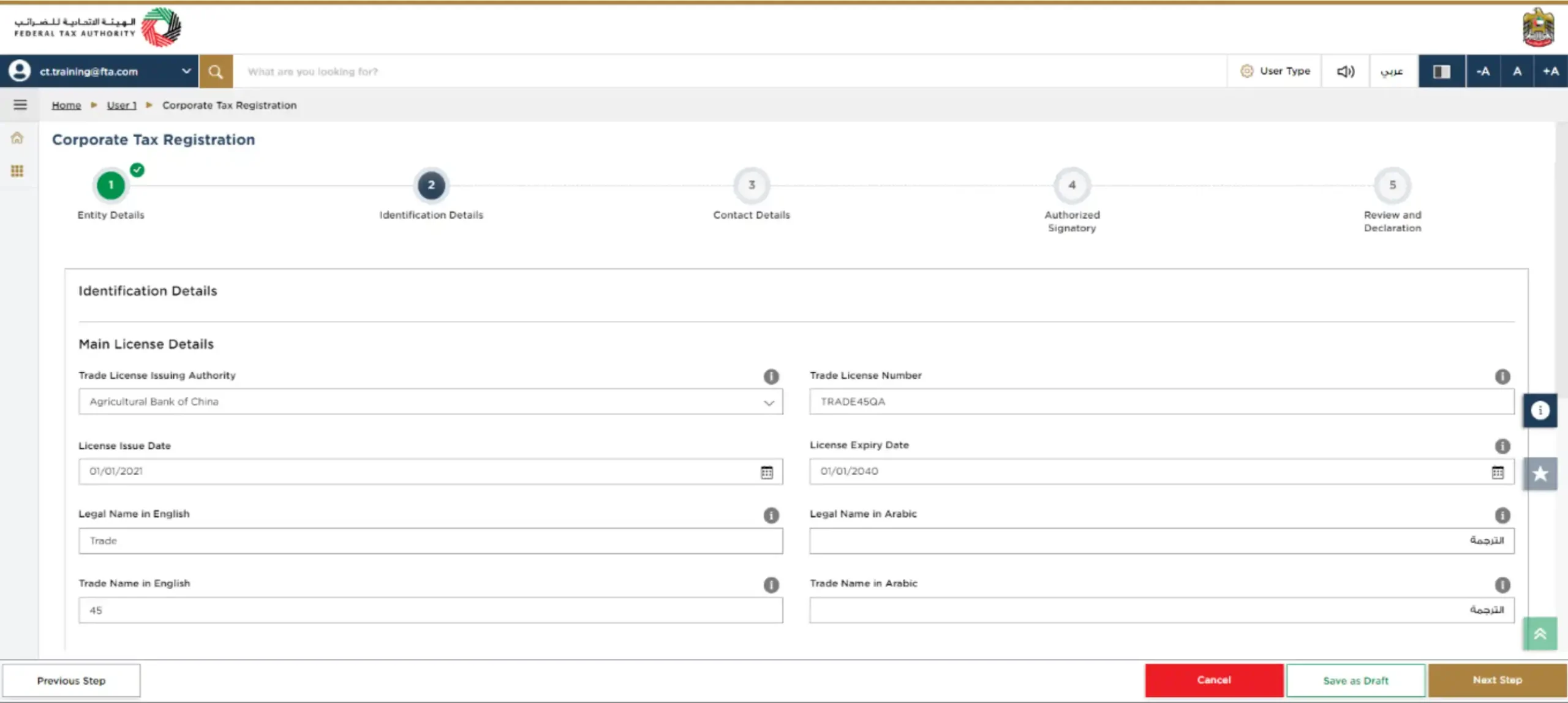

- Access EmaraTax (eservices.tax.gov.ae) and log in with existing credentials or UAE Pass. If new, sign up and verify your email.

- From the dashboard, select “Register for Corporate Tax” and add a new taxable entity if none exists.

- Choose entity type (e.g., Free Zone, Mainland, Branch).

- Enter business details: Trade License number, business activity, financial year, and branches.

- Add ownership details (individuals/entities with >25% ownership).

- Provide contact information (registered address, phone, email).

- Specify authorized signatories for tax submissions.

- Review all information carefully and submit the application.

Tax management can be challenging, especially when you have multiple branches and agencies. You can use Hamyar Union accounting software to automate your tax calculations, ensure accurate and error-free reporting, comply with UAE Tax Authority laws and regulations, and set access levels for different users.

What happens after tax registration?

The FTA will review your application and take approximately 20 business days to respond to you. You will then receive a confirmation via email with your Tax Registration Number (TRN). If there is a problem, you will be notified by email, and you can view the problem on your dashboard.

Note: Companies in a free zone can maintain a 0% tax rate by following certain rules, but doing business with companies and organizations located on the mainland can affect their tax exemption status.

Note: Returns must be filed annually within nine months of the end of the financial year. Failure to file returns on time may result in penalties or difficulties in renewing your company license.

If your company is taxable, you must pay your taxes within the same nine-month period, and companies must have sufficient funds to cover their financial obligations.

Taxable Persons in the UAE

Tax law applies to both resident and non-resident individuals. Residents are those who have companies registered in the UAE or are foreign companies whose management and control are in the UAE. It also includes natural persons who carry on business activities in the country.

Non-residents are those whose companies are permanently established in the UAE or whose income is derived from sources within the UAE.

Late Corporate Tax Return Penalty

After the deadline specified by the FTA, a late filing penalty is imposed on a monthly basis. The penalties are as follows: 2026 is calculated as follows:

- For the first 12 months, you will have to pay a penalty of 500 dirhams per month

- From the 13th month onwards, you will have to pay a penalty of 1000 dirhams per month until you submit your return.

- Late registration penalty: AED 10,000 (under Cabinet Decision No. 75/2023). However, under the ongoing FTA waiver initiative, this penalty is waived or refunded if the first Corporate Tax return or annual declaration is submitted within 7 months of the end of the first tax period.

Note: All the information in this article is based on official announcements from the authorities and FTA statements, but for accurate and up-to-date information on registering your corporate tax, you should visit the official page of the UAE Ministry of Finance to have more detailed information about corporate tax and the new laws related to it, and then proceed to submit the return.